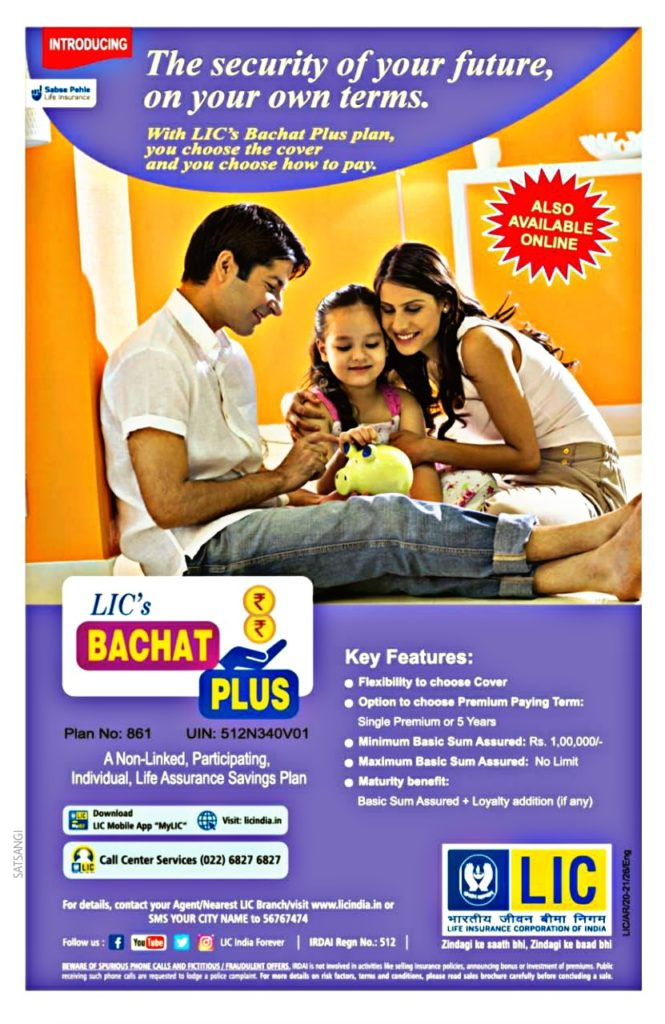

LIC's Bachat Plan and Its Policy Features

Introduction

Life Insurance Corporation of India (LIC) is renowned for offering a range of insurance products that cater to various financial needs. One such offering is the LIC Bachat Plan, a popular insurance policy that combines protection and savings. This article aims to delve into the features, benefits, and considerations associated with LIC's Bachat Plan.

LIC's Bachat Plan: An Overview

The LIC Bachat Plan is a non-linked, participating, endowment plan that provides financial security to policyholders and their families. It offers both life insurance coverage and a savings component, making it an attractive option for individuals looking to secure their loved ones' futures while accumulating savings over time.

Key Features and Benefits

1. **Death Benefit:** In the unfortunate event of the policyholder's demise during the policy term, the nominee receives a death benefit that includes the sum assured plus accumulated bonuses, if any. This ensures that the policyholder's family remains financially protected.

2. **Maturity Benefit:** If the policyholder survives the policy term, they are entitled to receive the maturity benefit, which consists of the sum assured along with vested reversionary bonuses and a final additional bonus, if applicable.

3. **Bonuses:** The Bachat Plan is a participating policy, which means policyholders can receive reversionary bonuses and a final additional bonus based on the company's performance and the policy's duration. These bonuses enhance the overall payout upon maturity or in the event of death.

4. **Loan Facility:** Policyholders can avail of loans against the Bachat Plan, providing them with a source of funds during emergencies.

5. **Flexible Premium Payment:** The plan offers flexibility in premium payment modes, allowing policyholders to choose between annual, semi-annual, quarterly, or monthly premium payment options.

6. **Surrender Value:** In case of financial hardships, policyholders have the option to surrender the policy after a certain period, and the surrender value can be claimed, subject to terms and conditions.

Considerations before Opting for LIC's Bachat Plan

1. **Policy Term:** Choosing an appropriate policy term is crucial. Longer terms may lead to increased savings and bonuses, but it's essential to align the term with your financial goals and needs.

2. **Premium Payment:** The premium amount is determined by factors such as age, sum assured, and policy term. Ensure that the premium payments are manageable within your financial capabilities.

3. **Financial Goals:** Define your financial objectives clearly. While the Bachat Plan offers both insurance protection and savings, it's important to assess if the plan aligns with your overall financial strategy.

4. **Bonuses and Returns:** While bonuses enhance the policy's returns, they are not guaranteed. Policyholders should have realistic expectations about the potential bonuses they might receive.

Conclusion

LIC's Bachat Plan combines the dual benefits of life insurance coverage and savings accumulation, making it a comprehensive financial tool for individuals seeking financial security for their families and a means to grow their savings. By understanding the plan's features, benefits, and considerations, potential policyholders can make informed decisions that align with their long-term financial goals. As with any financial product, it's advisable to consult with a financial advisor before committing to an insurance policy to ensure that it suits your unique needs and circumstances.

कोई टिप्पणी नहीं:

एक टिप्पणी भेजें